what is considered income for child support in colorado

Parents support child care and health care obligatoin shall not reduce net monthly income below 687. Because spousal alimony will no longer be tax deductible to the payor the definition of income for the purpose of calculating child support must change as well.

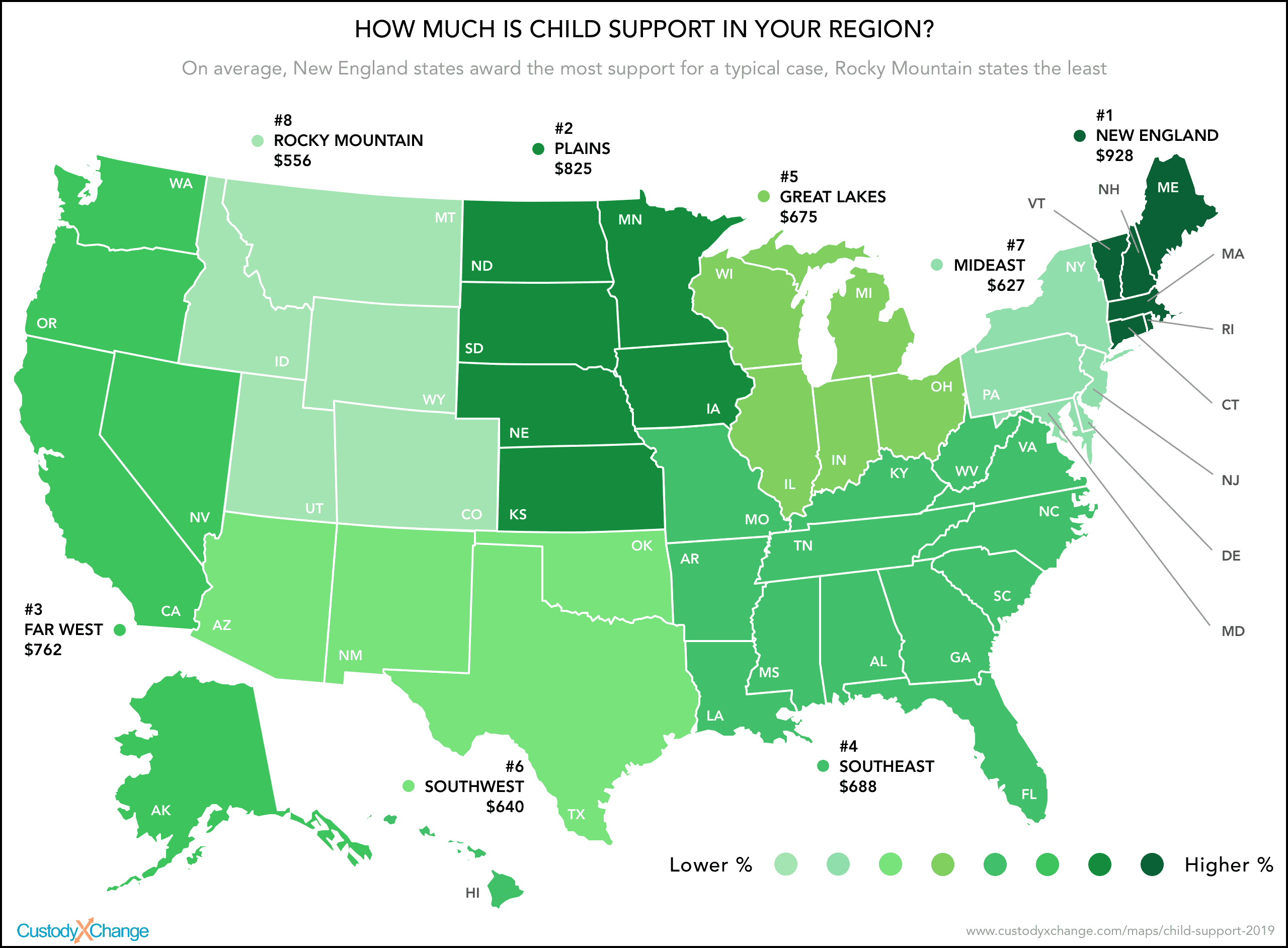

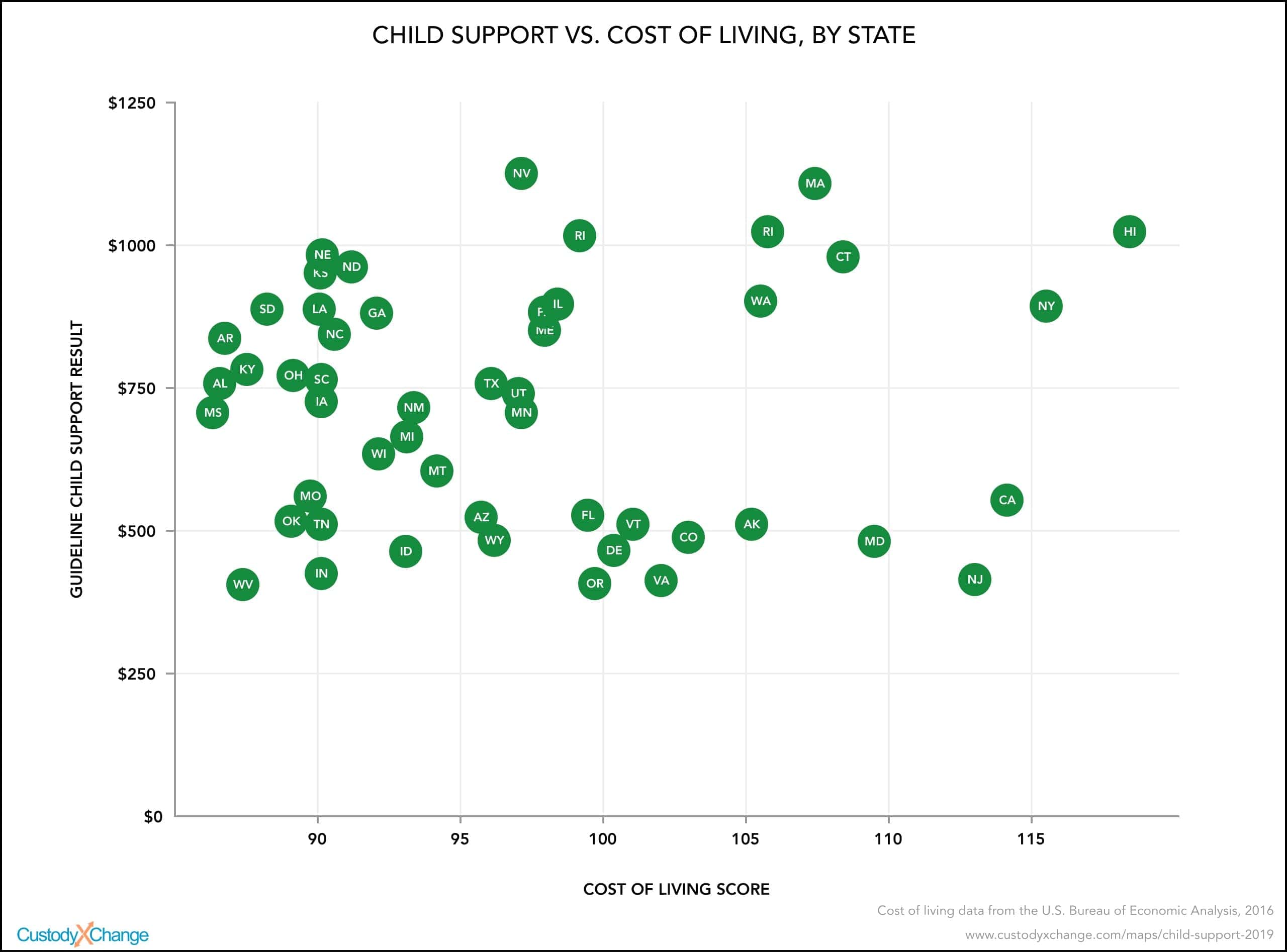

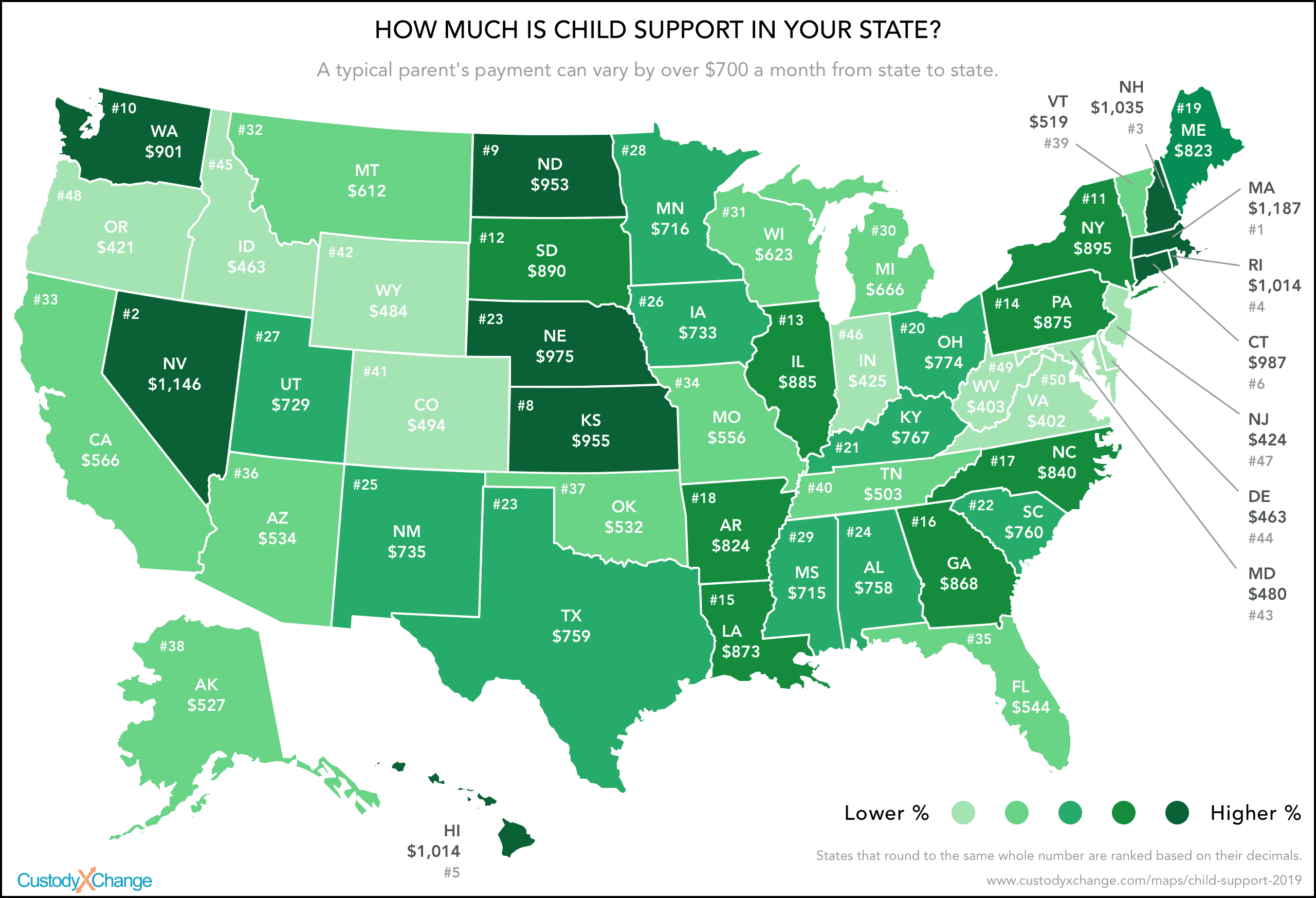

How Much Is Child Support In Your State Custody X Change

Total net income exceeds 15000 monthly.

. How Child Support Amount is Determined. 6 If the monthly adjusted gross income of either parent is 649 or less the tribunal shall determine the amount of the child support obligation on a case-by-case basis but the base child support award may not be less than 30. 3 annual overnights with each parent.

Much of the confusion of the definition of income in many states comes from the fact that state child support statues do not define exact inclusions for income. It is important to understand exactly what the law considers income when determining a child support award. The Colorado Child Support Guidelines are designed to make sure that a fair share of each parents income and resources are given to their child.

Depending on the circumstances it is possible for social security benefits retirement benefits loan proceeds and stock option sales proceeds to also be considered income in terms of child support. For a parent receiving spousal alimony their income. Some factors considered in a support calculation include.

Work- or school-related daycare. Based on this economic evidence the colorado child support guideline calculates child support based on each parents share of the amount estimated to have been spent on the child if the parents and child were living in an intact household1 if. The main factors include.

The Basics You Should Know About Child Support Calculations in Colorado. For example Colorado generally considers the interest earned on your IRA account to be income that should be included in the child support calculation. The gross income of both parents.

The Guidelines provide calculated amounts of child support up to a combined adjusted gross income level of. Colorado calculates child support using the Income Shares Model of support which is based on the gross income of both parents and general information about what intact families spend on their children. Other sources of unrealized income that the state may rule should be included are unrealized gains from unexercised stock options and retained earnings from corporations partnerships or sole proprietorships.

Gross income before taxes of both parents. Child support for amounts in excess of 15000 monthly may be more but shall not be less than the amount that would be computed using the 15000 monthly income unless other permissible deviations exist. 2 number of children.

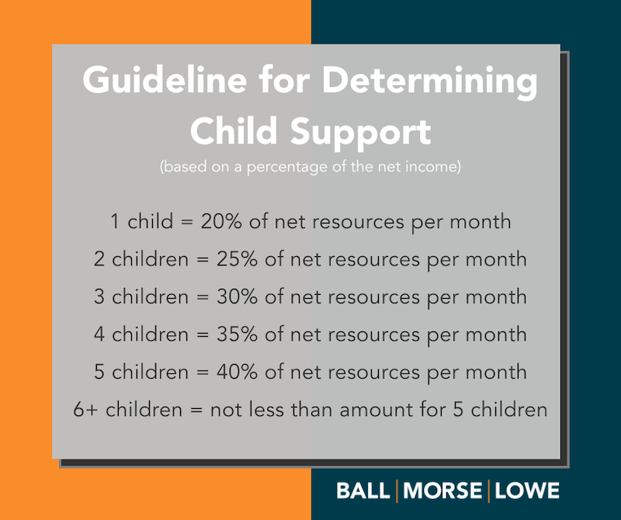

Each parents gross income. Child support is a percentage roughly 20 for 1 child and an additional 10 for each additional child of the combined gross income of the parents which is then split between both. Income can refer to more than just the wages you earn at.

Basically this means that you are responsible for reporting any money that you receive with the exception of lottery winnings as a source of income when you are being reviewed for a support order. Child support amounts are typically based on the parents income and time spent with the child. Amount of child support ordered to be paid exceed the amount of child support that would otherwise be ordered to be paid if the parents did not share physical custody.

Basically child support guidelines include as income any source of funds available to the parent taking into consideration all possible financial sources. The following may be factored into the formula. Child support and alimony are intertwined as child support is calculated using each partys gross income which includes spousal alimony.

7031 Koll Center Pkwy Pleasanton CA 94566. The noncustodial parents share of support sets the amount of the order. Income Part 1 In Colorado numerous factors go into calculating child support.

In the state of Colorado income that can be used for child support is income that is obtained from any source. In Colorado child support is calculated with consideration of the following factors. Calculation of the gross income of each parent gross income being income from any source other than child support payments public assistance a second job or a retirement plan.

The guidelines use a formula based on what the parents would have spent on the child had they not separated. What is considered income for child support in colorado. The more income a party has the greater is their share of support obligation.

As a non-custodial parent the one who cares for the child less than 50 of the time you will be required to pay child support to the other party the custodial parent. Significant expenses specific to the child such as. 3 annual overnights with each parent.

Gross income refers to most types of earned and unearned income including wages salaries tips bonuses overtime pensions unemployment benefits workers compensation benefits and Social Security. 5 the childrens share of health. Under Colorado law the amount of child support that is determined in a child support action is typically tied to the income of the parties.

Unrealized Parental Income and Child Support. Regardless of whether parents split up or stay together they owe their children financial support to cover basic needs such as food housing clothing and an education. The starting point for determining the child support payments in Colorado is the pre-tax income of each parent.

The childs income if any The number of overnights the child spends with each parent. Under Colorado Revised Statutes Section 14-10-115 a parents adjusted gross income refers to his or her gross income minus pre-existing child support and alimony obligations. 1 monthly income of both parties.

4 work and education related child care costs. This article examines what Colorado considers as income in determining child support obligations. 3000000 per month 36000000 per year.

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

How Much Is Child Support In Your State Custody X Change

How To Modify A Child Support Order In Colorado

How Much Will My Child Support Payment Be Supportpay

Child Support An Essential Guide 2022

How To Not Pay Child Support With Pictures Wikihow

Ohio Child Support Calculator Child Support Laws Calculate Child Support Pay Child Support Calculator Child Support Quotes Child Support Laws Child Support

How Much Is Child Support In Your State Custody X Change

Child Support Financial Laws Responsibilities

This Infographic Offers Some Information About What Is Child Support Why Should You Need To Know About Child Maintenance Th Supportive Child Support Children

Child Support Definition Examples Cases Processes

Child Support In Texas How It Works

Frequently Asked Questions Colorado Child Support Services

Child Support Basic Obligation Colorado Family Law Guide

Do I Need A Lawyer For Child Support Findlaw

Child Support Agreement Template Check More At Https Nationalgriefawarenessday Com 13355 Child Support Agreeme Custody Agreement Child Support Support Letter

Does Child Support Increase If Salary Increases Goldman Law Llc

Calculate Child Support Payments Child Support Calculator Colorado Company Announces Online Solution To Calcul Child Support Quotes Child Support Supportive